The sales slowdown impacted both urban and rural communities, with rural areas generally facing more challenges. The ski resort town of Sun Peaks experienced the most significant decline among all submarkets, with sales declining by 40.2%. However, notable exceptions include Pineview Valley and Clearwater, which saw strong increases of 62.8% and 28.0%, respectively. Pineview Valley’s rise in desirability can be attributed to the construction of the new Pineview Valley Elementary School in Kamloops, set to break ground next year. The rise in Clearwater was driven by heightened demand associated with the construction of the Trans Mountain pipeline.

Despite less demand, which has led to a recent increase in inventories, Kamloops still has a shortage of homes. As of December 2023, there were 740 active residential listings, an 11.4% increase compared to December 2022. However, the available inventory falls 12.1% below the 10-year average for December. The uptick in listings is primarily attributed to a slowdown in demand rather than an increase in overall supply. In fact, in 2023, there were only 4,494 new listings, reflecting a 5.9% decline compared to 2022. The limited supply adds another layer of challenge to an already difficult market for buyers, limiting their options and further slowing down the overall market.

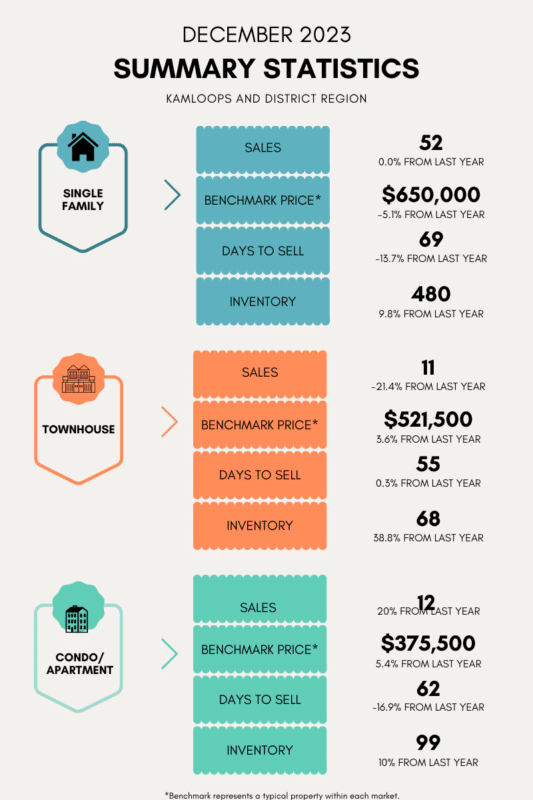

For instance, limited choices have compelled individuals in an aging population to age in place, further reducing the availability of homes entering the market. In December 2023, the composite Benchmark Price for all categories and submarkets reached $572,900. Although prices declined 11.3% from their peak in May 2022, they have rebounded with a 4.8% increase from December 2022 to December 2023. The surge in 2022 was fueled by unrealistic gains in a frenzied market, necessitating a correction. Despite the recent decline, the market has maintained a steady long-term trend with a 4.5% annual compound growth since 2005. Notably, this growth persisted in 2023. The period between 2007 and 2015 witnessed minimal growth, highlighting the contrast with the recent positive trend.

Interest rates are expected to remain unchanged for the foreseeable future, but economists suggest possible cuts into the summer of 2024. While it’s considered premature to discuss rate cuts, the Bank of Canada emphasizes the need for consistent evidence of inflation heading back to 2% before any policy easing. Canada is thought to be finished with raising rates, yet addressing inflation remains a priority. Inflation, which was over 8% last year, eased to 3.4% in December 2023. Although this is slightly higher than the month before, the increase was anticipated and expected to be temporary. Past rate increases will continue to impact the economy, restricting spending and limiting growth and employment to control inflation. Looking ahead, the market is expected to undergo its traditional slowdown earlier in the year, with a subsequent moderate pickup. However, the increase is not expected to reach the levels observed in 2021 and 2022. Consumer confidence is on the rise due to stable mortgage rates. With fixed rates already dropping to low 5%, and the potential for rate cuts, this is likely to entice some who were previously hesitant to enter the market. The recent slowdown in prices creates an opportunity for buyers. However, mortgage affordability will remain a barrier for some. Supply is expected to remain a challenge into the next year, with limited new construction underway due to high building costs and infrastructure expenses. The upcoming B.C. government rules, set to regulate short-term rentals by May 2024, may offer some extra housing supply. The Kamloops housing market stands resilient, attracting individuals with its central location, favorable weather, and outdoor activities. The market’s affordability compared to other markets in BC, coupled with a steady economy, makes it an attractive place to live. This contributes to a cautiously optimistic outlook for the local real estate market.

PREPARED BY PROFESSIOAL ANALYTICS

Leave a Reply